Startups today are inundated by the narrative of being showered with copious amounts of funding. Companies can hit astronomical – and some would say logic-defying – valuations, as investors place large bets on companies in the hopes of landing a golden goose. Indeed, there’s a lot of hype around the VC-startup relationship, but is it healthy for the entrepreneurial ecosystem?

Startups today are inundated by the narrative of being showered with copious amounts of funding. Companies can hit astronomical – and some would say logic-defying – valuations, as investors place large bets on companies in the hopes of landing a golden goose. Indeed, there’s a lot of hype around the VC-startup relationship, but is it healthy for the entrepreneurial ecosystem?

How can investors avoid a sense of FOMO (‘fear of missing out’) when looking at trendy but not necessarily lucrative investment opportunities? And how can they apply more logic and sense to a financing decision and securing the right investee?

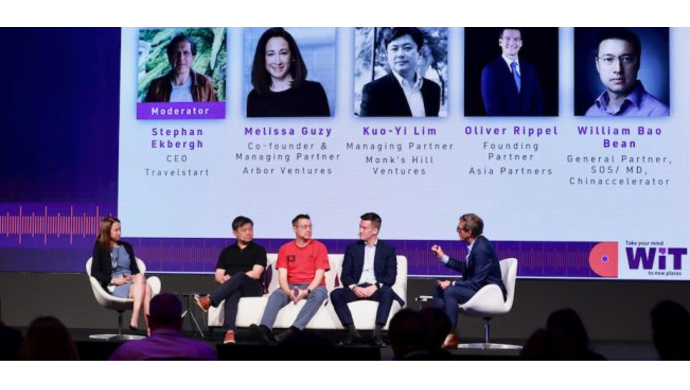

At a panel discussion at WiT 2019, VCs from across global markets discussed strategies investors should apply to make more sound investment decisions, and how startup founders can develop stronger relationships with their investors.

Moderated by Stephan Ekbergh, CEO of Travelstart the panel included William Bao Bean Managing Director of Chinaccelerator; Kuo-Yi Lim of Managing Partner, Monk’s Hill Ventures; Oliver Rippel, Founding Partner of Asia Partners; Melissa Guzy, Co-founder & Managing Partner, Arbor Ventures.

Here are the key takeaways:

Don’t fear FOMO; think about the long-term approach instead

The temptation to give in to FOMO will always be there. And for VCs that focus on making a limited number of significant deals annually, there will inevitably be times when they miss out on companies that eventually turn out to be a winner.

However, the panel advised that instead of feeling regret, investors should ask themselves a fundamental question: “Based on the same amount of information available at that point in time, would I still have made the same investment decision?”

If the answer is “yes”, then they have built a system of strong investment values that is consistent and repeatable across different cycles, which is more important than being driven by emotions that can be illogical and lead to short-sighted and ill-advised decisions. Staying true to the philosophy that has served them well in the past will keep them on track to making stronger investment choices.

Investing in business means investing in its founder, which is akin to getting into a long-term relationship or marriage, said Bean. It is a lot of commitment and investors are usually tied up with the company for at least five to 10 years. It’s a lot of effort and devotion to an impulsive investment decision.

Before investors sign a cheque, what they really need to consider is whether they would be willing to continue working with a founder and company during a downturn. Are they prepared to fight through tough times and tackle problems together? Does the company’s culture align with its philosophy and would they be able to overcome conflict amicably?

Backing the right founder and building strong relationships

To judge a founder’s capabilities, character and compatibility is not a simple task. Today, however, investors can leverage advanced tools to filter out founders who may not be a good fit or whose character is suspect.

For example, there was talk about developing AI programmes that can assess any founder’s behaviour profile based on online data, to give investors a clearer sense of if they will be good to work with or if they should be kept at arm’s length. Investors could also use the HBDI (Hermann Brain Dominance Instrument) test to analyse how a founder would approach a decision-making process.

Nonetheless, measuring the calibre and integrity of a founder is not an exact science.

Many entrepreneurs, especially in Southeast Asia, are young upstarts in their mid-20s whose behaviour and thought processes are still subject to major change as they continue to mature. Plus, it is virtually impossible to predict every possible scenario that could occur, regardless of how much due diligence is done on the founder and their company.

Ultimately, investors have to feel comfortable working with the founder and their team from day one. “Make sure you are a good fit,” said Guzy. “As an entrepreneur, it can take 35-40 venture firms before you find the right one. There are lots of ingredients that go into if a match can work and you have to meet a lot of VCs to find the one you want to partner with.”

After that match is made, maintaining an open, communicative relationship is fundamental to sustaining a long and happy ‘marriage’. Lim advised that it is more productive for founders to open and vulnerable about business than feel the need to pitch about how great the business is doing all the time. Being honest about the challenges a business is facing will help investors get a better sense of what support they can provide to overcome any problem.

Rippel added, “The biggest mistake is trying to manage everything in your board room meeting… Keep the quarterly board meeting to focus on the bigger things that matter and what you need to keep things going.” Beyond the boardroom, he advised regular meetups to work through the smaller, grittier details of the business that both sides can work through together.

Most importantly, the investors advised that a positive relationship is one where founders can feel vulnerable with their investors. Founders should feel comfortable writing emails or weekly newsletters to their investors that speak openly about struggles and achievements. Ditch the polished, PR lingo; speak the unfettered, unvarnished truth that comes from the heart instead. Investors appreciate honesty and directness, and this way founders and their investors will develop a stronger bond.

—

This article was first published on WiT.

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Join our e27 Telegram group here, or like e27 Facebook page here.

The post Being level-headed, judicious and open key to making wise investment decisions appeared first on e27.