Incomlend, an online global invoice exchange platform, is in the final stages of closing its Series A equity fundraising with large global equity investors, a top executive of the Singapore-headquartered startup told e27.

The company, however, didn’t share more details.

“By the end of 2019, Incomlend will be closing its Series A equity fundraising, with already identified large global equity investors. The announcement on the closing of the Series A round will be published in December 2019 or January 2020,” Co-founder and CEO Dimitri Kouchnirenk said.

Incomlend was established in 2015 by former Columbia Business School classmates Kouchnirenko and Morgan Terigi as software that could provide finance directly to trading companies from a private investor pool.

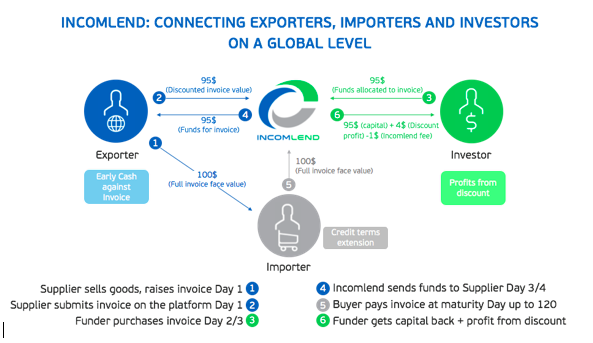

In the current form, Incomlend is a multi-currency invoice exchange platform connecting businesses and private funders. It serves as a marketplace where suppliers can sell their invoices online directly to individuals or companies willing to purchase them. As a result, the supplier obtains cash in exchange for a discount rate paid to the funders of the invoices.

How the platform works

Clients register online through Incomlend’s onboarding module. Once verified and credit insurance obtained, clients are given access to the invoice trading marketplace to perform their transactions such as submitting invoices, adding new buyers/suppliers, adding/withdrawing funds, and monitor the activities.

In factoring, the supplier submits invoices for finance, payable by the buyer at a later term (maximum 120 days after the invoice’s issuance date). Incomlend checks the invoice and related documents within two days. Once the invoice is vetted, the fintech firm lists the invoice on the marketplace.

Incomlend then pre-allocates funds to the invoice from investor’s instructions in less than 24 hours usually. Once funding for the invoice is confirmed, the supplier can request to withdraw the funds on the same day.

This allows the supplier to get early cash against its invoice, payable at a later date by the buyer. When the invoice’s payment term comes due, the buyer pays the invoice directly to Incomlend.

In reverse factoring, the buyer submits invoices for finance issued by its suppliers. The supplier is notified and chooses to discount the invoice. Incomlend checks the invoice and related documents within two days. Once the invoice is vetted, Incomlend lists the invoice on the marketplace.

Incomlend then pre-allocates funds to the invoice from investor’s instructions (in less than 24 hours, usually). Once funding for the invoice is confirmed, the supplier can request to withdraw the funds on the same day. Following that, the buyer pays the invoice directly to Incomlend up to 120 days later, which effectively allows the buyer to extend its existing credit terms with the supplier.

Incomlend takes a transaction processing fee from the exporter and a discount profit share from the investor.

Private investors in the Incomlend’s network comprise Accredited and Institutional investors. These are investment funds, financial institutions such as banks, asset and wealth management firms, family offices, even some businesses with excess cash to place.

To date, Incomlend has processed over 2,000 deals since its launch in 2016 and is now present in over 50 countries, globally. Over 400 clients are registered on the platform to date.

Major importer countries include Singapore, Hong Kong, the UAE, Canada, Germany, Australia and New Zealand.

Major exporter countries are India, China, Indonesia, Malaysia, Saudi Arabia, Malaysia, Vietnam, Chile, Nigeria and Belgium.

“Southeast Asia is still an untapped market in terms of export finance. It is one of the fastest-growing export regions in the world, yet largely underbanked on SMEs compared to regions like Europe. Furthermore, intra-Asia import-export flows are also expanding rapidly, faster than any other region, thanks to the ASEAN trade dynamics and expanding local consumption. This opens large opportunities for intra-Asia Supply chain finance on the importers’ side,” added Kouchnirenk.

In March 2018, the fintech firm received an undisclosed sum in funding from GTR Ventures, an investment and venture-building platform specialised in trade and supply chain.

Image Credit: 123rf Stockphotos

The post (Exclusive) Online invoice exchange platform Incomlend close to securing Series A funding from global investors appeared first on e27.