Keep in mind: Ethereum is already using a small country’s worth of electricity

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Is it worth it?

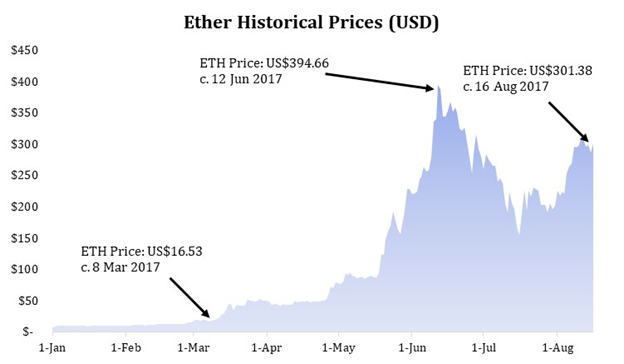

A constantly repeated question, especially now that the price of Ethereum is rising. Ethereum, this year, has seen an almost 20x jump in price. This increase in price has led to people, who would have otherwise not thought twice about cryptocurrency, sit down and become suddenly extremely interested. When this happens, I believe that most of the biggest profits have already been made.

People had been mining the coin for months or years prior. And, they would have seen some tremendous gains, especially if they had a decent sized operation. For many people, the value of Ether in their wallet has increased by over 20x.

Okay, let’s get back to the question, “Is it worth to start mining?”

If you are just hearing about Ethereum and interested in maybe jumping onboard, that can be a very difficult question and it depends on a lot of factors. Well, hopefully, this article will help you get an idea of whether it is a good idea to mine Ethereum.

What is Ethereum?

In elementary terms, Ethereum is an open software platform based on the blockchain technology that enables developers to build and deploy decentralized applications.

I remember a friend once came up to me and asked me:

Are Bitcoin and Ethereum similar?

Well sort of, but not really.

Like Bitcoin, Ethereum is a distributed public blockchain network. There are, of course, some significant technical differences, but the most important difference is that they differ substantially in purpose and capability. Bitcoin offers one application — peer to peer electronic cash system that enables Bitcoin payments. Whereas, the Ethereum blockchain can support many different types of decentralized applications.

Wait a minute, if it is a network, how is a price assigned to Ethereum?

If someone says that he or she has invested in Ethereum, they have actually bought Ether (ETH). Ethereum is a network, whereas, Ether is the fuel required to power it. Ethereum, of course, can not be traded. Ether, on the other hand, is traded and it appreciates and depreciates in price. The price of Ether is what fluctuates based on the demand.

Ethereum has lots of real-life uses, for example, supply chain, healthcare, banking etc. More the number of applications, more the Ether required and hence the price increases.

Also read: Can blockchain technology create another era of Asian tigers?

So how do I get Ether?

Well, there are few different ways to earn Ether. But the two most common ones are:

1. Cryptocurrency exchanges

These exchanges work exactly like forex exchanges. You can buy, sell or trade cryptocurrencies for other digital currencies or traditional currencies like US Dollar, Euro, Singapore dollar etc.

2. Mining

Mining originates from the gold analogy of the cryptocurrency sphere. In the simplest terms, cryptocurrency mining is a process of solving complex math problems. These “miners” are people that spend time and energy solving these math problems. Miners provide the solution to the issuers who verify it and then reward the miner with a block of Ether (Proof-of-work).

Mining sounds easy. Should I start now?

Wait a minute. Before you start, there are quite a few things you would need to keep in mind.

Cryptocurrency mining, including Bitcoin and Ethereum, has become increasingly harder for miners to make a profit. All miners need to check a few statistics including the mining hardware’s hash rate execution, the coin network’s current difficulty and the electrical costs associated with mining.

1. Hash Rate

A Hash is nothing but a mathematical problem that a miner needs to answer. The rate at which the miner solves these problems is the Hash Rate. As the number of miners joining the Ethereum network increases, the computers (CPUs/GPUs/ASICs) available for mining also get better and provide a higher hash rate.

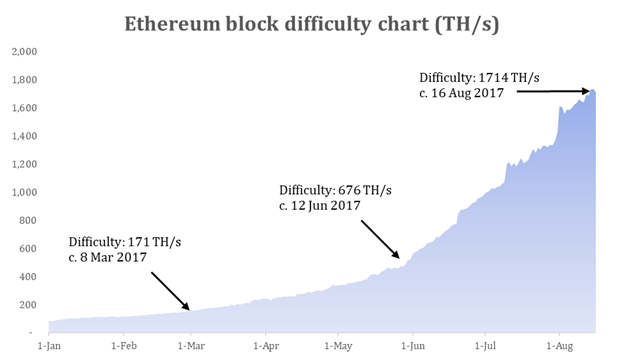

2. Mining difficulty

A measure of how difficult it is to find a solution to the mathematical problem. The Ethereum network is designed to produce a constant number of coins every few minutes. As the Hash rate of the computers is increasing, the mathematical problem also gets more and more difficult to solve.

So, as more miners join the Ethereum network, the harder it becomes to solve the problem — increasing the mining difficulty.

3. Electricity

Now as very powerful computers are running to solve these complex problems, a high amount of power is also being used to support these machines and their calculations. So, the cost of electricity also should be factored when calculating the return on your mining investment. Ethereum Is Already Using a Small Country’s Worth of Electricity

Remember: As the price of Ethereum has been rising, there are more and more miners joining the Ethereum network every day. The more the miners, the higher the hash rate of machines but the more difficult the mathematical problem. So, more time consumed by the computer to complete one calculation and receive one block of Ether and consequently more electricity consumed.

In addition to these factors, one should also incorporate the cost of the device and the maintenance expenses while calculating the ROI.

Let’s take an example …

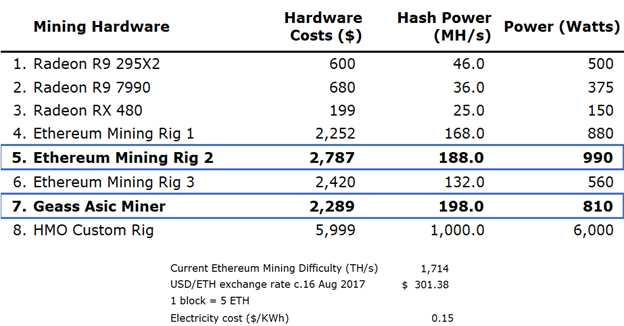

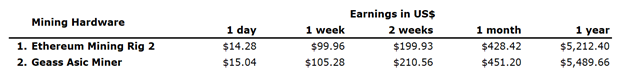

Suppose you buy a mining rig which consists of 6 Radeon RX 480 GPUs (Ethereum Mining Rig 2) or you buy a Geass Asic Miner and set it up for Ethereum mining (as shown in the blue border in the image below). Let’s compare both these two systems and see if Ethereum mining is worth it.

By doing some back of the envelope calculations, in one month I can earn 1.4 ETH using the Ethereum Mining Rig 2 or 1.5 ETH using the Geass Asic Miner. Besides, one would also be spending at least $100 per month in electricity.

Note: We know that the difficulty of mining will increase every month. So, the amount of ETH earned in 1 year would be much less than the amounts mentioned in the image above.

Looking at these figures, mining seems to be a good proposition, and we could achieve break even in about 6 to 7 months. However, just like any computer that operates consistently, factory parts can malfunction, and miners often need fan replacements because devices run so hot. I have not included the maintenance cost as well the electricity consumed by these other parts. If one were to cover these expenses, I would assume break even to occur only after one year. As the difficulty increases, the profitability of mining Ethereum would drop until there comes the point where it will not be profitable to mine.

Now, let us look at it in another way. Instead of spending US$2,000+ in buying the mining rig and the electricity that I would end up consuming in a month, one could have purchased 8+ ETH. If one used the amount potentially spent in a year, one could buy as much ETH as one could mine in a year.

Moreover, Ethereum will be switching from a Proof-of-work to a Proof-of-Stake framework sometime in 2017. This could mean a hard stop for mining. If and when Proof-of-Stake hits, all of the hash rates of ETH will instantly move to other coins, ETC, Zcash etc. Immediately the difficulty of those coins will quadruple, and the profitability will reduce massively. We’ll all be trying to mine from a smaller pot of cash.

A switch to proof-of-stake could also mean a higher demand for ETH resulting in a significant increase in the price of ETH.Keeping all these points in mind, I believe that profitability from ETH mining would reduce significantly over the next few months. There are a lot of moving parts that affect the ROI. I think soon all the casual miners will be squeezed out and a group of large firms will remain.

—-

The post Given all the buzz about blockchains and cryptocurrency, should I start mining Ethereum? appeared first on e27.