Google made a big splash this morning when it announced it’s going to acquire Looker, a hot analytics startup that’s raised more than $280 million. It’s paying $2.6 billion for the privilege and adding the company to Google Cloud.

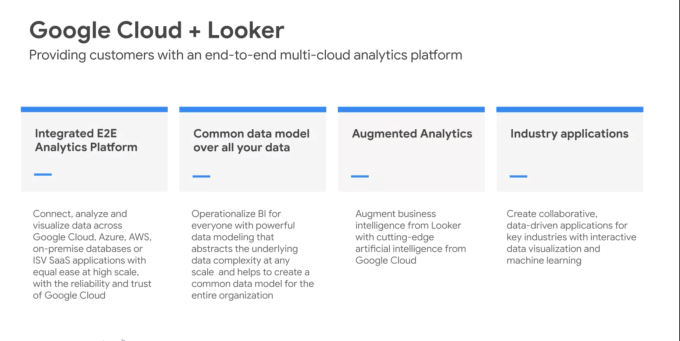

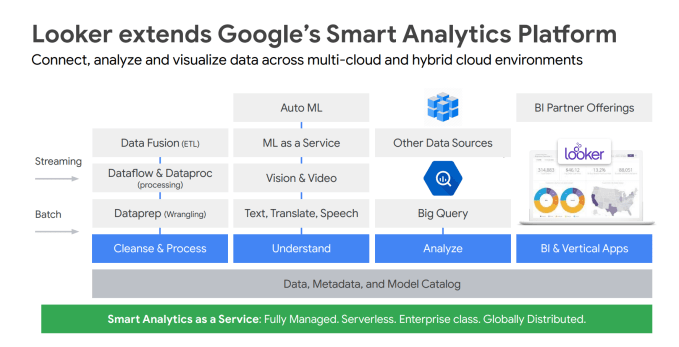

Thomas Kurian, the man who was handed the reins to Google Cloud at the end of last year, sees the two companies bringing together a complete data analytics solution for customers. “The combination provides an end-to-end analytics platform to connect, collect, analyze and visualize data across Google Cloud, Azure, AWS, on-premises databases and ISV applications,” Kurian explained at a media event this morning.

Google Cloud has been mired in third place in the cloud infrastructure market, and grabbing Looker gives it an analytics company with a solid track record. The last time I spoke to Looker, it was announcing a hefty $103 million in funding on a $1.6 billion valuation. Today’s price is a nice even billion over that.

As I wrote at the time, Looker’s CEO Frank Bien wasn’t all that interested in bragging about valuations; he wanted to talk about what he considered more important numbers:

He reported that the company has 1,600 customers now and just crossed the $100 million revenue run rate, a significant milestone for any enterprise SaaS company. What’s more, Bien reports revenue is still growing 70 percent year over year, so there’s plenty of room to keep this going.

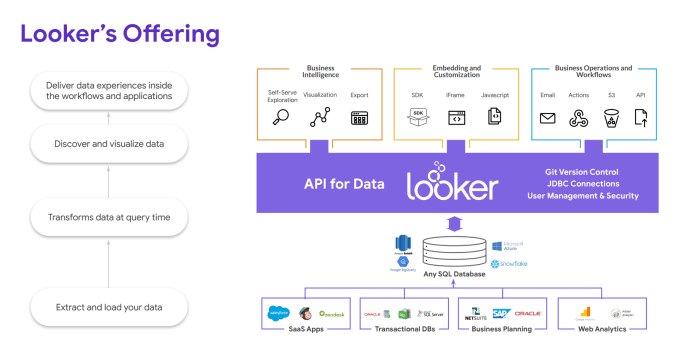

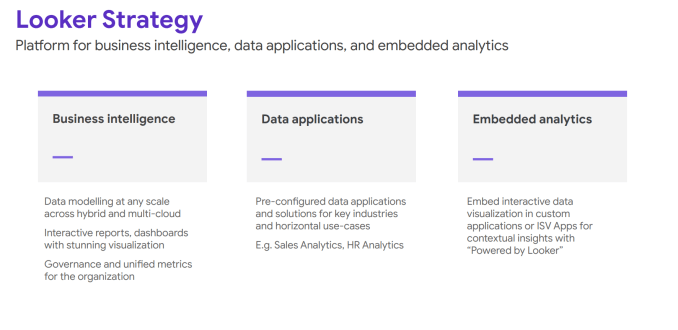

Today, in a media briefing on the deal, he said that from the start, his company was really trying to disrupt the business intelligence and analytics market. “What we wanted to do was disrupt this pretty staid ecosystem of data visualization tools and data prep tools that companies were being forced to build solutions. We thought it was time to rationalize a new platform for data, a single place where we could really reconstitute a single view of information and make it available in the enterprise for business purposes,” he said.

Diagram: Google & Looker

Slide: Google & Looker

Bien saw today’s deal as a chance to gain the scale of the Google cloud platform, and as successful as the company has been, it’s never going to have the reach of Google Cloud. “What we’re really leveraging here, and I think the synergy with Google Cloud, is that this data infrastructure revolution and what really emerged out of the Big Data trend was very fast, scalable — and now in the cloud — easy to deploy data infrastructure,” he said.

Kurian also emphasized that the company will intend to support multiple databases and multiple deployment strategies, whether multi-cloud, hybrid or on premises.

Perhaps, it’s not a coincidence that Google went after Looker as the two companies had a strong existing partnership and 350 common customers, according to Google. “We have many common customers we’ve worked with. One of the great things about this acquisition is that the two companies have known each other for a long time, we share very common culture,” Kurian said.

This is a huge deal for Google Cloud, easily topping the $625 million it paid for Apigee in 2016. It marks the first major deal in the Kurian era as Google tries to beef up its market share. While the two companies share common customers, the addition of Looker should bring a net gain that could help them upsell to other parts of the Looker customer base.

Per usual, this deal is going to be subject to regulatory approval, but it is expected to close later this year if all goes well.