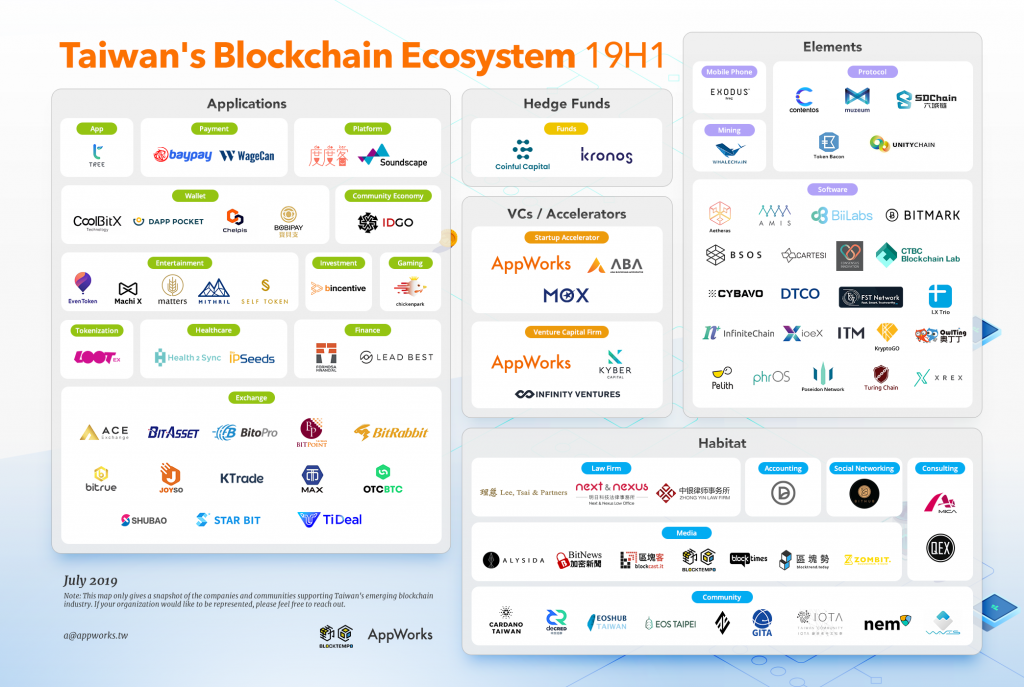

Here’s a high-level view of Taiwan’s blockchain industry

In the first half of 2019, Taiwan’s blockchain industry shook off last year’s steep decline in crypto prices and proceeded to show positive developments. These past few months saw Taiwan’s financial authority, the Financial Supervisory Committee (FSC), release the first draft of security token offering (STO) regulations, while also pledging more resources to further incubate the country’s blockchain capabilities.

Although there weren’t as many new ventures created compared to 2017 and 2018, existing players in Taiwan’s blockchain industry have been resilient. Since we released our first blockchain ecosystem snapshot 6 months ago, only 8 organizations have ceased operations and were taken off the chart.

At the same time, leaders like MaiCoin, BitoEX, and OwlTing have begun diversifying their service offerings and developing new solutions to fast-track user adoption. Meanwhile, the small handful of new additions, including KrytpoGO and Bincentive, are seemingly more attuned to industry pain points, at least compared to their peers.

Proliferation of exchanges

Unsurprisingly, exchanges continue to serve as the most pervasive application serving the blockchain/crypto space. In addition to becoming the first operator in Taiwan to apply for the STO sandbox, MaiCoin Group, which operates MAX exchange, is trying to reshape Taiwan’s capital markets by opening up the country’s first physical storefront to process KYC in person.

Through face-to-face interaction, the group hopes to build up trust and credibility in an industry that’s been ripe with scams, hacks, and privacy breaches.

At the same time, some exchange operators are now leveraging their technical acumen to branch into infrastructure plays. Local exchange BitoEX is now building a blockchain-based system to track and store data relating to any SME’s supply chain finances.

Also Read: Blockchain startup BlockPunk launches tokenised anime film and NFC-enabled art print

Given the immutability of distributed ledger technology, banks can comfortably use the information to facilitate commercial loans or appraise assets without the fear of compromised data. The data can also aid regulators in evaluating companies that want to eventually tokenize their assets and conduct an STO.

These past six months have also seen new exchanges emerge. ACE Exchange, for example, has been attracting its initial crop of users through the allure of initial exchange offerings (IEO), an alternative financing vehicle in which the exchange itself vets, facilitates, and lists a project’s token offering.

Among the many exchanges out there, however, none captured the attention of industry stakeholders more than COBINHOOD. In an almost Netflix drama-like fashion, the homegrown, zero-fee cryptocurrency exchange experienced ongoing internal power struggles and shareholder disputes that eventually led the founder Popo Chen to suspend the local entity and let go all of its staff. COBINHOOD and the affiliated protocol initiative DEXON are now on lockdown while all technical and legal controversies are resolved.

Responding to market demands

Although the number of new projects may have declined compared to previous years, blockchain solutions have certainly become much more tailored to immediate market needs.

For example, since cryptocurrency service providers such as exchanges and wallets have not been subject to strict supervision, the blockchain industry generally lacks infrastructure related to regulatory compliance. KryptoGO is a newly established regtech startup that developed a solution to help banks and regulatory agencies analyze on-chain data to help automate risk control.

Bincentive, on the other hand, fully believes in the future of cryptocurrencies and aims to help traditional investors get a piece of the action. By combining AI, social trading, and smart contracts, the startup has developed a Smart Mirror Trading Platform that essentially allows clients to not only follow, but mirror the trades of vetted crypto traders, who then earn a share of the profits.

Through this platform, Bincentive hopes to bridge digital currencies with traditional financial assets, helping the former to eventually become a recognized alternative investment class in and of itself.

Additionally, OwlTing—an early mover in Taiwan’s startup landscape—officially launched OwlTing Blockchain Services (OBS), a collective offering of blockchain solutions incorporating 6 years of experimentation spanning multiple industries including food traceability, hotel management, travel, and anti-counterfeiting. Last year, the company raised US$10 million from Japanese venture capital firm SBI.

Regulations get more defined

This map was produced by AppWorks in conjunction with local blockchain media Blocktempo. Apart from conducting primary research, we used information from our own respective networks, communities, and investment partners, and pored through local and international news. The map will be updated every half year to adequately capture the sheer pace at which the industry is evolving.

This past June, the FSC released a draft of what may be the “world’s first” set of STO regulations. Under the new provisions, startups can be approved for STOs as early as October this year, but are still held to a relatively short leash.

Those fundraising via security tokens are capped at NT$30 million (~US$1 million). Furthermore, only accredited investors are allowed to invest, with a limit of NT$300,000 (~US$10,000) in any single project. Any startup looking to raise in excess of the set threshold must apply to the regulatory sandbox, just as MaiCoin has.

As applications of cryptocurrencies have started to expand beyond just trading, Taiwanese decision makers will also look to broaden the scope of KYC/AML regulations in the second half of 2019. Moving forward, any projects working in the realm of digital payments and remittances will likely have to apply for a special license in order to operate.

Despite all the cautionary measures, the government has taken several forthright steps to incorporate blockchain into Taiwan’s future. At the opening of the Asia Blockchain Summit in July, Minister of the National Development Council (NDC) Chen Mei-ling announced the agency’s plans to form a blockchain alliance with representatives from industry, academia, and relevant government bodies. The initiative hopes to accelerate the development of Taiwan’s blockchain industry, including everything from strengthening R&D to cultivating talent to fostering global partnerships.

Also Read: 5 Asia-based startups that are making blockchain part of everyday life

The National Development Fund—Taiwan’s sovereign wealth fund—has also reportedly begun investing in blockchain ventures, XREX (an AppWorks portfolio) being the most recent case.

At the same time, other public departments in Taiwan are also beginning to experiment with distributed ledger technology. For example, the Ministry of Justice Investigation Bureau hopes to leverage the immutable nature of the blockchains to optimize the administrative process of issuing national IDs.

Forward-looking optimism

Overall, excitement is resurging within Taiwan’s blockchain industry. Crypto prices are well on their road to recovery, with Bitcoin having now almost topped US$13,000.

The second annual Asia Blockchain Summit in Taipei attracted over 4,000 attendees from around the world and 100 speakers, including Binance’s CZ, TRON’s Justin Sun, and Bitmex’s Arthur Hayes. And two of the largest companies in the world—Facebook and JPMorgan Chase—launched their own blockchain projects, Libra and JPMCoin, surely a positive endorsement by anyone’s standards.

For AppWorks Accelerator, we’ve now facilitated two batches of startups exclusively focusing on blockchain / AI, collectively amounting to 65 startups, 29 of which were working on blockchain/crypto/dapp related projects.

Also Read: Here’s how blockchain can transform the compute resource economy

Entertainment, whether it’s gaming or gambling, seems to have represented the majority of projects that blockchain founders tend to work on, truly speaking to what exactly early adopters are willing to pay for at this stage of the industry—not so unlike the early days of the internet.

Moreover, while Ethereum has traditionally occupied the limelight, we see more and more public chains such as EOS or TRON becoming popular, each offering their own unique value proposition—a trend we expect to continue moving forward.

Disclosure: AppWorks is a fully independent venture capital fund/startup accelerator and is not currently affiliated with any of the companies or organizations mentioned in the article, with the slight exception of BitoEX, which previously went through our equity-free accelerator, and XREX, which we’ve invested in.

—

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Join our e27 Telegram group here, or our e27 contributor Facebook page here.

The post How Taiwan’s blockchain industry is powering through the downturn appeared first on e27.