Being a tech whiz or a creative genius isn’t enough

Anyone who’s ever binge-watched an entrepreneurial-themed reality TV show like Shark Tank or Dragon’s Den will quickly spot a pattern during the Q&A session.

The potential investors almost always begin with questions about finances, such as “What is your revenue?”, “What are your margins?”, “How much have you personally invested in the company?” and “When and how do you expect to break even?”

The entrepreneurs who do not know their numbers inside out find it hard to convince the panel and rarely walk away with a deal.

For an entrepreneur with a great product or service, the thought that a brilliant concept by itself is not enough may come as a shock. Doesn’t it matter that your product solves a real problem? Don’t the investors see they could be part of The Next Big Thing!?

The hard truth is that when it comes to fundraising for startups, being a tech whiz or a creative genius is not enough. Investors want to see that the person receiving their money will utilise it well, make sound financial decisions, and give them a high return on their investment.

That means, as a founder, you can’t leave the number-crunching to the accountant or the business development lead. You’ve got to own your financial data and have it at your fingertips if you want a shot at securing funds from venture capital (VC) and private equity (PE) firms.

Not surprisingly, you can be guaranteed to be up against some tough competition.

Also Read:

A Stanford survey in 2016 found that for every startup that receives funding, VCs typically consider 100 companies. Those startups that successfully raise funds tend to do so only after some 40 investor meetings, according to DocSend.

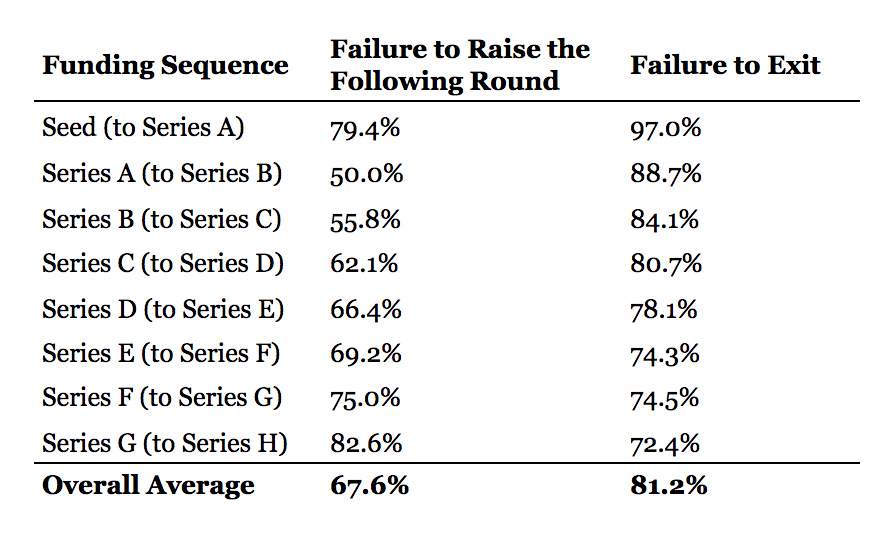

What’s more, in its analysis of 35,568 startups founded between 1990 and 2010, Radicle Labs found that it gets increasingly difficult to raise more funds beyond a Series B round, often deemed as the ‘valley of death’.

Here’s what the data says:

That makes sense—after a company raises its third (typically Series B) round, it’s expected either to be self-sustaining while remaining private or to exit through an IPO or a merger and acquisition.

Additional funding rounds tend to be justified only with growth and expansion plans or as preparation for going public.

But note how it’s also pretty difficult to get from seed to Series A, with 79.4 per cent of startups failing to do so, according to Radicle Labs. That means startups need to work doubly hard to come up with a strong fundraising pitch backed by numbers.

The role of accounting and finance in pitch rejections

Studies of investment decisions have identified four main criteria that VCs consider: product/service, market, entrepreneur/management team, and financials. Failure in each of these areas (or, typically, in a combination of at least two criteria) can lead to a rejected pitch.

From around the web, here are some finance and accounting-related reasons for pitch rejection, given by investors and founders alike:

- Not thoroughly understanding and communicating the financial dynamics (from Barry Kumarappan, a real estate fund founder).

- Unclear and inaccurate financial assumptions (from Ron Flavin, a funding consultant).

- Not thinking about why they need the money (from Fanuel Dewever, founder of a crowdfunding platform).

- Not talking about the financial plan (from Brian Cohen, an angel investor).

- Problematic capitalisation table; weak unit economics (from Sarah A. Downey, a VC principal).

- Unrealistic sales projections, gross margin assumptions, and annual revenue projections (from Martin Zilling, a founder).

Financial statements and data for a fundraising pitch

VCs and PEs pour significant amounts of money into startups, so it makes sense for them to conduct due diligence before making an investment.

When it comes to financials, they typically ask the company to provide bank statements, financial statements, and key assumptions (the last one applies especially if the company is fundraising for a Series B or later round).

Also Read: The magic 8: here’s a look at the 2019 judging criteria for TOP100

Financial statements include balance sheets, income statements, and earnings and cash flow statements. They also present data on operating expenses, cost of goods sold, and gross margins.

Key assumptions include five-year projections of monthly and annual revenue, gross profit, order size, and the number of orders. Startups will also need to project customer acquisition cost, or how much you need to spend to get someone to buy your product or pay for your service.

This metric is typically compared to the churn rate—how fast you lose clients—and each customer’s lifetime value (LTV). (A high acquisition cost might be offset by a low churn rate coupled with high LTV.)

There’s really no hard-and-fast rule as to what financial data to include when pitching to investors, and the information you present often depends on how many years your company has been operating.

Also Read: An overview of Vietnams venture capital industry

Some companies with long R&D phases, such as biotech firms, may need money to continue their tests and research. Others, like Singaporean snack startup box green, are able to begin raising revenue even before receiving seed funding.

One of the best ways to know what financial statements to include in your pitch deck is to identify the data you have and the projections investors need to see. For example, Square, an online payments company, shared growth and margin projections up to the year 2015 in a pitch deck that is used in 2011 or 2012.

In raising a US$10 million Series B round in 2004, LinkedIn shared five-year financials, including revenues, expenses, cash flow, net cash position, and operating margins.

Moz, which offers search engine optimization tools, likewise included margins and profits, as well as current and estimated revenue, customer LTV, and cost of acquisition, among other key financials.

Best of all, Sequoia Capital, a 46-year-old venture capital firm, shared a template that explains what a pitch deck should ideally contain. The slide on financials, for example, should include profit and loss, balance sheet, cash flow, capitalisation table, and the deal that the startup is asking for.

Founders: brush up on your accounting skills

If you’re not sure just how big a deal financial information is in a pitch deck, consider research by DocSend, which shows that potential investors spend the most time viewing this data compared to other parts of the deck.

On average, viewers spend 23.2 seconds looking at the financials slide, compared to 22.8 seconds for a team, 13.9 seconds for a product, and 11.3 seconds for the problem, among other pages.

Startup founders who aren’t exactly accounting-savvy need to brush up on their skills and practice creating different kinds of financial statements that meet accounting standards. They also need to learn to build realistic and feasible financial models.

Also Read: Last year TOP100 gave away over S$100,000 worth in prizes. Expect more this year!

As venture investor Dave Parker writes, “At some point, some investor is going to ask a question that will drive you to the spreadsheet.” When that time comes, be ready to find that data and explain how you crunched the numbers.

Keep in mind that even if your projections end up being wrong, it’s worth showing potential investors that you’ve done your homework and have poured much thought into how you will maximize the funds they’ll give you.

There is no shortcut or secret to surviving the ‘valley of death’. Beyond the innovative product and stellar founding team, it all boils down to the bare numbers.

—

Image Credits: Elizabeth Hoffmann

e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

The post How to win on Shark Tank and survive the ‘Valley of Death’ appeared first on e27.