Shopee saw its adjusted revenue grow by 16x between the years 2017 and 2018

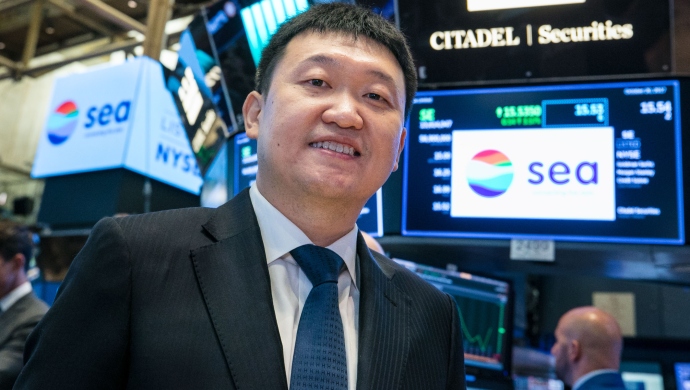

Executives and guests of Sea Limited (NYSE:SE) visit the New York Stock Exchange (NYSE) to celebrate their IPO. To mark the occasion Chairman & Chief Executive Officer, Forrest Li, rings The Opening Bell®. .

Sea Group, the Nasdaq-listed umbrella company of Shopee, Garena and Airpay, announced today that it is trying to raise US$1.5 billion, “for business expansion and other general corporate purposes”.

As pointed out by TechCrunch, most of that money should be funneled into Shopee — Sea Group’s rising-star business unit that recently helped drive a nice stock price rally.

Sea Group will issued 60 million Class A shares, which amounts to US$1.35 billion, in an underwritten public offering. It also plans to sell 9 million shares to the underwriters, which brings the total amount they are hoping to raise to US$1.5 billion.

It is planning to sell each share for US$22.50 and will close the offering on March 8 (Friday). The company’s current stock price is hovering around US$24 per share after it enjoyed a 48 per cent spike (from US$16.20) when it released its Q4 and Year-end financial results.

The recent rally catapulted Founder Forrest Li into the Bloomberg Billionaires Index.

Sea Group is expecting organisations affiliated with Tencent (a previous investor) and an entity affiliated with an unnamed Sea Group Director to buy 6,300,000 shares worth US$141,750,000.

Shopee was founded in 2015, first as a P2P marketplace like Carousell, and has since grown into a full-blown e-commerce marketplace. Over the past few years it has become a very serious competitor to Lazada, Qoo10 and Bukalapak.

Also Read: Grab raises US$1.46B from the SoftBank Vision Fund

To give an idea of the bullishness around Shopee, the Sea Group stock price spike coincided with 2018 losses (both Net loss and adjusted EBITDA) that nearly doubled the 2017 number. The company net loss in 2018 was over US$944 million and its adjusted EBITDA showed a loss of US$694 million. In 2017 those numbers were losses US$480.5 million and US$332.1 million respectively.

Theoretically, doubling losses should not lead to a significant stock price rally..

But, if we dive into the adjusted revenue from e-commerce (aka Shopee), the enthusiasm starts to seem logical. In 2017, Shopee’s adjusted revenue was US$17.7 million. In 2018, the amount of money Shopee made grew 16x to US$290 million.

Its cost of revenue did increase by 325.3 per cent to US$171.2 million, but it is hard to ignore the fact that Shopee seems to be gaining serious traction.

Also Read: These sweet sixteen startups are taking on the competition at TOP100 Thailand

Gaming is still the core product for Sea Group (its adjusted revenue was over US$660 million) and Sea Group as a whole crossed the US$1 billion adjusted revenue number in 2018, a more-than 10 per cent increase from 2017.

—

The post Sea Group trying to raise US$1.5 billion likely aimed at Shopee appeared first on e27.