Globally, e-commerce is expected to see US$4.06 trillion in sales by 2020, making this an important issue

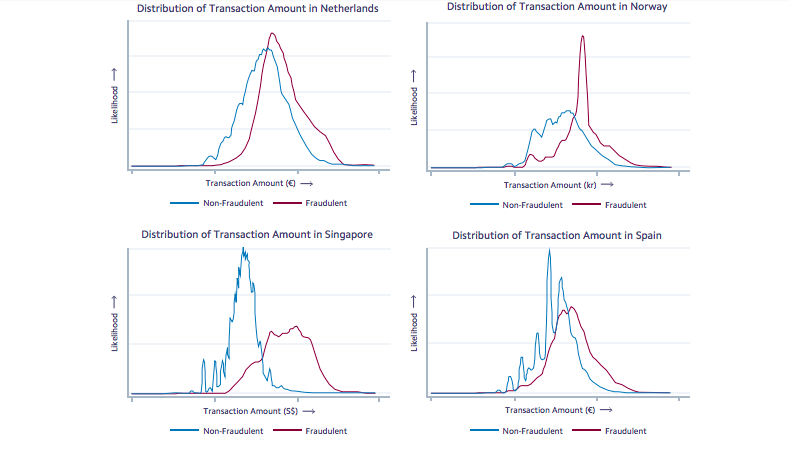

While the typical Singapore resident is less likely to be victimised by online payments fraud, when incidents do occur the perpetrator will steal significantly more than an the average shopping cart; a trend that is fairly unique globally.

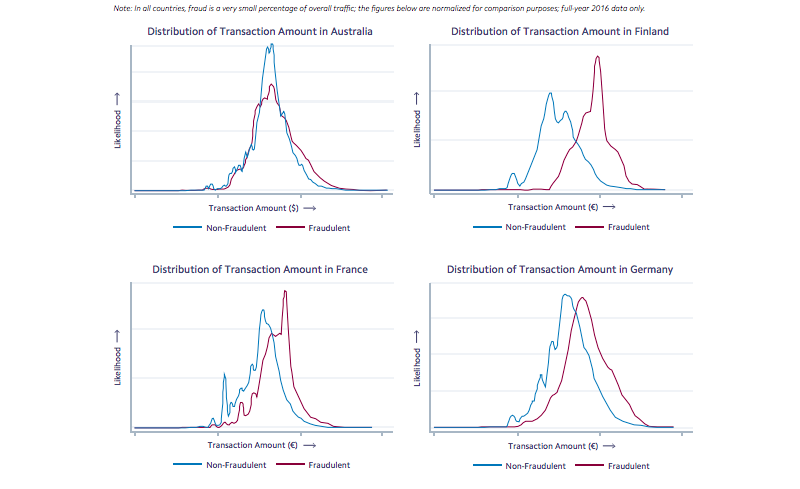

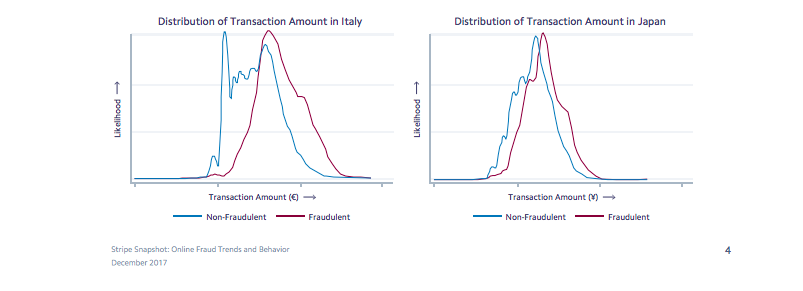

According to a new report from Stripe, fraudsters typically steal about the same amount as the amount the average person spends online. The report provided data from 13 countries and only Finland and Norway showed the same trend as Singapore.

The other Asian country highlighted in the report was Japan and it follows the global trend whereby the perpetrators steal slightly more than what a person typically spends, but only by a slight margin.

As pointed out by Piruze Sabuncu, the Stripe Head of Southeast Asia and Hong Kong, people should be clear to differentiate the fact that, “It’s more accurate to state this as the likelihood of fraudulent transactions from a specific credit card country of origin.”

So it may be more about security protocols for specific companies rather than a statement on the country as a whole.

“The most important thing to note is that fraud is a very small percentage of overall volume, so merchants should be careful about instituting blanket rules to block an entire country,” she said.

Also Read: Need to optimise your e-commerce platform? Here is a profile of your Southeast Asian customers

Here are the country-by-country graphics:

One of the interesting facts about online fraud is a downtime pattern. Yes, fraud goes up during the holidays and over the summer, but Stripe dug into the numbers and found that fraud actually rises on off-days.

So, on notable shopping bonanzas like Single’s Day or Black Friday, instances of fraud doesn’t rise. It’s actually days like Christmas when people are not shopping.

Sabuncu pointed to three possible reasons for the trend.

“This could be happening for a few reasons. One could be the fact that fraudsters are striking when no one is looking — when the reaction time of businesses are low. The other hypothesis is that fraudsters operate from different countries, and thus are conducting their activities during hours when businesses’ regular customers are asleep,” she said.

“Finally, there could be a possibility that fraudsters have day jobs and are conducting their activities when they have free time, after work,” she added.

This even bears out on a day-to-day basis when fraud peaks during sleeping hours and takes a break when business starts to rev up.

The reason this type of information is important is because online businesses bear more of the brunt for fraud than their offline counterparts. According to Stripe, every US$1 stolen costs and desktop-based store US$2.62 and a mobile e-commerce site US$3.34.

The global e-commerce industry say US$1.9 trillion in sales in 2016, a number that is expected to increase to US$4.06 trillion by 2020.

Understanding how fraudsters work, and how to go about protecting companies, is going to be a huge part of a large, growing, industry over the next few years.

—

Copyright: everythingpossible / 123RF Stock Photo

The post Singapore less likely to experience e-commerce fraud, but victims lose a larger chunk appeared first on e27.