Centralised crypto exchanges will die

My journey with cryptocurrency began when I was a student, but only really took off when a friend offered to pay me $100 worth of Bitcoin (0.055BTC at the time). Having to set up a wallet from scratch and create an account on Quoinex only to find that they didn’t have Bitcoin pairings for NEO and QTUM highlighted the limitations of exchanges at the time.

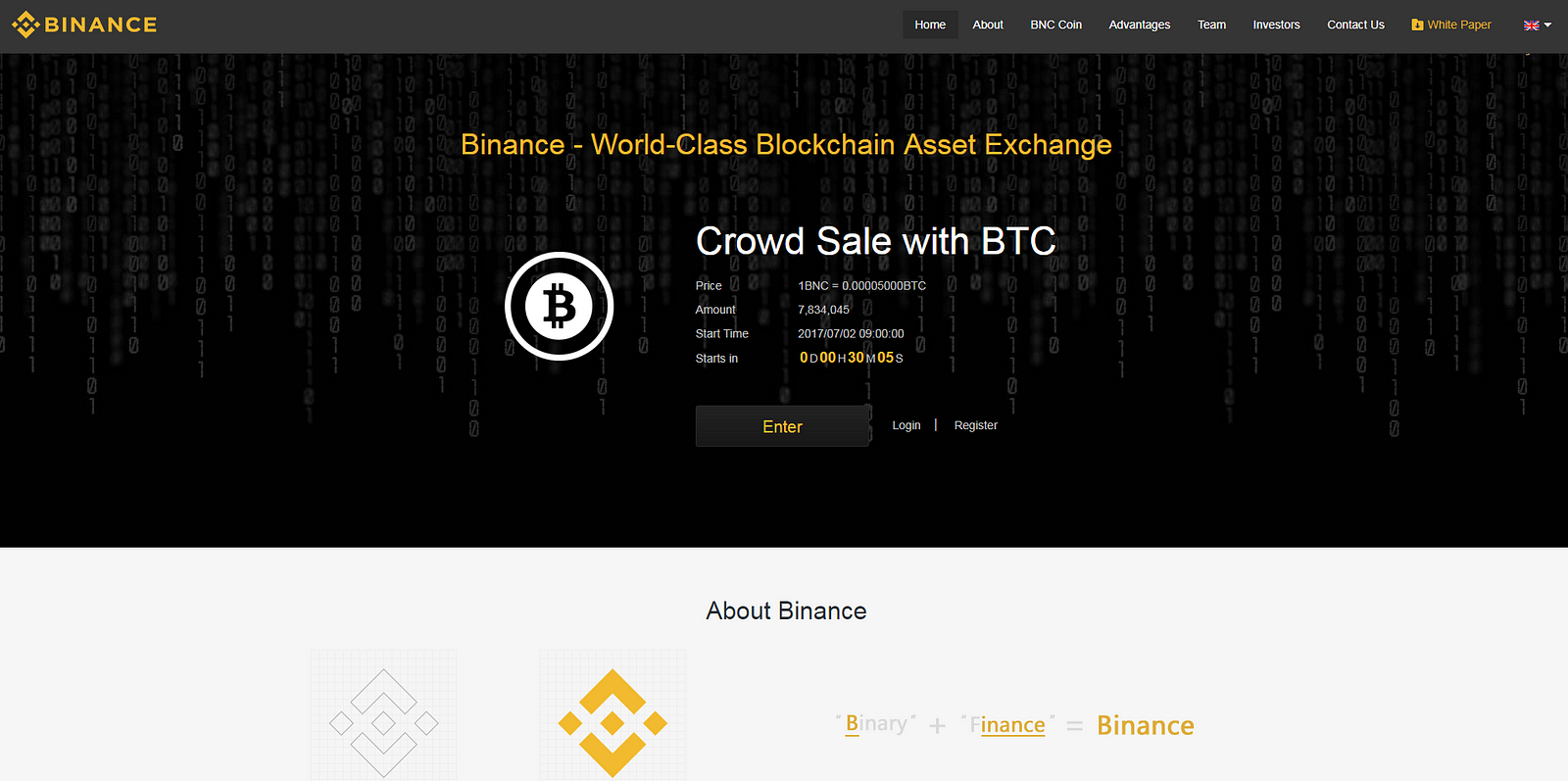

The need to use another exchange, Bittrex, to trade my Bitcoin for NEO and QTUM seemed inefficient and inconvenient, and it was around this time that Binance was having its Initial Coin Offering (ICO).

I saw Binance as part of a new generation of exchanges that were much faster, able to handle a larger load, and far more secure. They listed new coins faster than most other centralised exchanges, paid GAS to NEO token holders, and had low trading fees. Times have changed however, and Binance has begun to charge hefty fees to list tokens (up to $5m USD), slowing down their listing process significantly. Binance has also been vulnerable to hacking attempts. These gaps are the reason why we started our own decentralised exchange: Switcheo.

The Next Generation of Exchanges

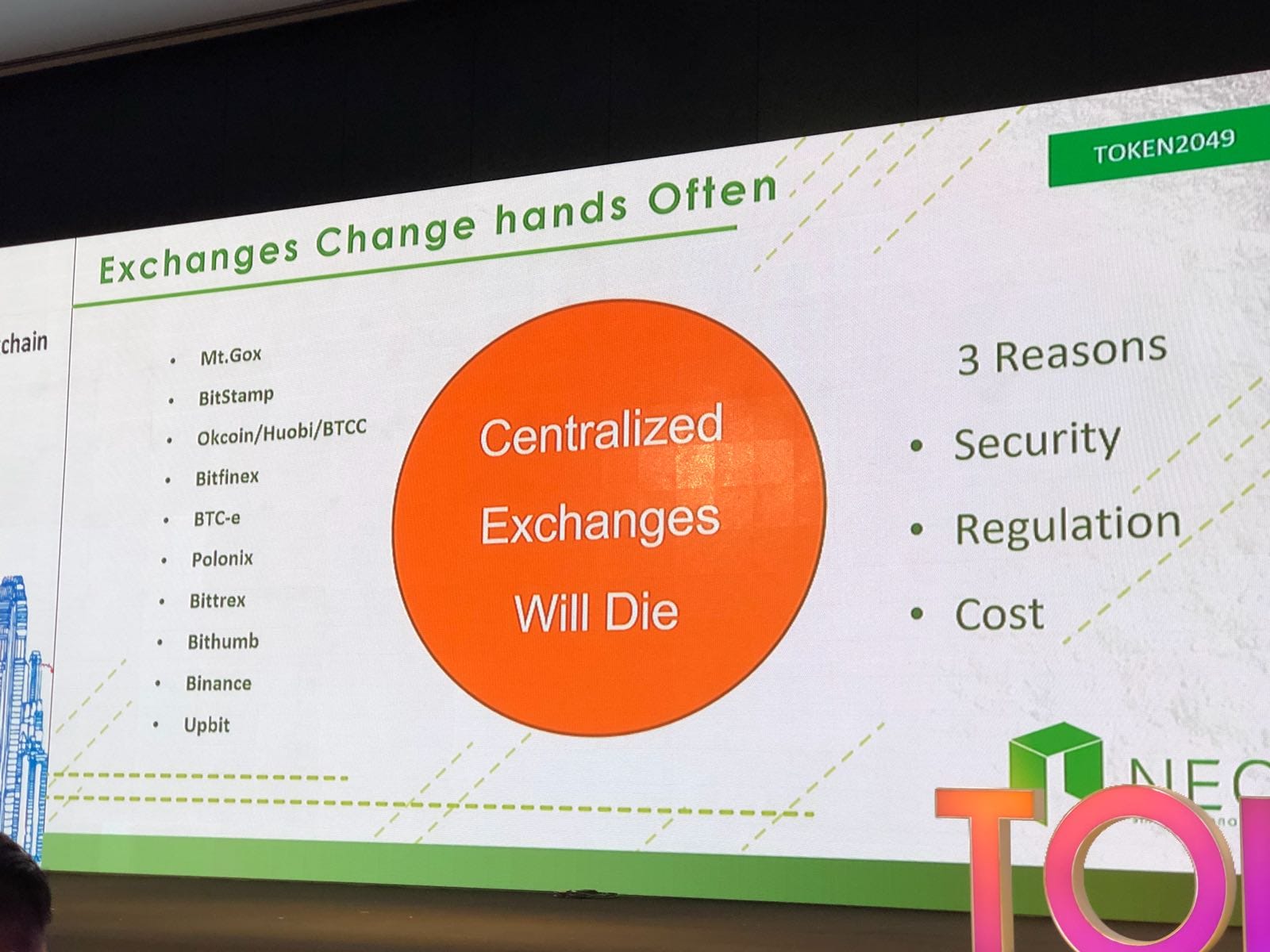

It is evident that the next generation of cryptocurrency exchanges will take on a different form. A sentiment shared by leading figures such as Vitalik Buterin, the founder of Ethereum, who recently mentioned that “I definitely hope centralized exchanges go burn in hell as much as possible,”and Da Hongfei, the founder of NEO, who also stated that “Centralised exchanges will die.”

Future exchanges will have to address the following issues in order to remedy the pains current exchanges and projects have within the current blockchain ecosystem:

1. 100 per cent decentralised

The ethos of cryptocurrency lies in the first sentence of the Bitcoin whitepaper:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

An exchange of the future should not be vulnerable to single point of failure or susceptible to the exchange’s desecration. It should allow users to connect directly from their existing wallets so that funds are always in their control and facilitate the peer-to-peer transfer of value without going through any external institution. These are the fundamentals of decentralisation.

2. Token listings should cost next to nothing

The monopoly that current exchanges have over listed projects only emphasises the divide in the cryptocurrency community. Projects should not have to raise more funds than necessary to spend on listing, and the project’s supporters should not have to wait months for tokens to be listed.

3. Allows trading across the blockchain

In order to participate in ICOs, we now have to manage accounts on a multiple of cryptocurrency exchanges.

Although the idea of cryptocurrency is the decentralisation of your assets, it should not be done by spreading your assets across multiple exchanges.

The shortcomings of ICOs in their current form are apparent as some tokens are only listed on certain exchanges. Although decentralised exchanges address this issue by listing all tokens on a certain blockchain, the majority of DEXs are blockchain specific, existing solely on a single blockchain.

Also read: More than just tech, your blockchain or crypto platform needs a killer tagline

For a DEX to compete head to head with current cryptocurrency exchanges, it must be blockchain agnostic, allowing trading across different tokens across multiple blockchains.

4. Dead simple to use

Ease of use is a key factor in user retention for complex financial products like exchanges. Many early cryptocurrency exchanges put little emphasis on their user experiences. This resulted in final products that were far too complex for basic traders to understand. The next generation of exchanges will have to focus heavily on user interface and experience, all the while keeping them familiar to the average trader.

5. Volume and liquidity

Traders are attracted to exchanges with thick order books and are less partial to those without them. If there is low volume and liquidity of different pairings on an exchange, trading is discouraged as traders make a loss on the spread when performing a taker offer.

To draw market makers to their platforms, exchanges need more complex APIs and attractive maker fees. Market makers encourage trading by adding volume and playing both sides of the market, making it more attractive for organic traders.

10 years have passed since the advent of cryptocurrency, and there is much to be done in building the next generation of exchanges. As decentralised exchanges like Switcheo begin to expand to different blockchains, like NEO, QTUM and Ethereum, the blockchain will begin to truly embody the ethos of a trustless economy.

—-

e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Photo by Icons8 team on Unsplash

The post What will it take for the next generation of crypto exchanges to succeed? Here are 5 must-have features appeared first on e27.