Although Amazon clearly has an edge over Flipkart, the Indian e-commerce giant cannot be written off yet, say experts

In February this year, it was reported that Chinese e-commerce giant Alibaba was planning to acquire Flipkart, the largest home-grown e-commerce company in India. However, the talks did not make much headway, as Alibaba — which is also an investor in Snapdeal — felt that the Indian e-commerce giant was overvalued.

A few days later, Morgan Stanley, a minority investor in Flipkart, marked down the e-commerce firm’s valuation of US$15 billion by 27 percent. The Bangalore company saw the valuation go down several times again, which now stands at US$9 billion.

Flipkart, once considered as the poster boy of India’s e-commerce industry, is gradually losing the ground. The growth has stagnated in the past two years, employees are worried about massive layoffs, and the top management was rejigged thanks to their poor performance.

Adding to the woes, Amazon — world’s largest e-commerce company that forayed into India six years after Flipkart launched operations — has grown really fast and become a force to reckon with. Amazon has also gained from the poor performance of Snapdeal, once Flipkart’s key rival. Alibaba-backed m-commerce platform Paytm is also fast catching up.

Also Read: Indian startup unicorns: When marriages seem an inevitable death-defying gamble!

Flipkart is losing the ground

“Flipkart has lost ground in the last two years,” says Jayadevan PK, Managing Editor of FactorDaily, a new media company tracking technology in India. “Since last Diwali (in October 2016), the unit shipments haven’t increased and there has not been much QoQ growth.”

A stagnant growth means the top companies are fighting for the same market share and same set of consumers. “Even though Flipkart was not performing at its best in the past 18-24 months, its smaller rival Snapdeal was doing worse and it lost a huge market share during this period. One’s loss is another’s gain. Amazon clawed Snapdeal’s pie, bringing it closer to Flipkart,” he adds.

Snapdeal is reportedly exploring a possible merger with Amazon and Flipkart.

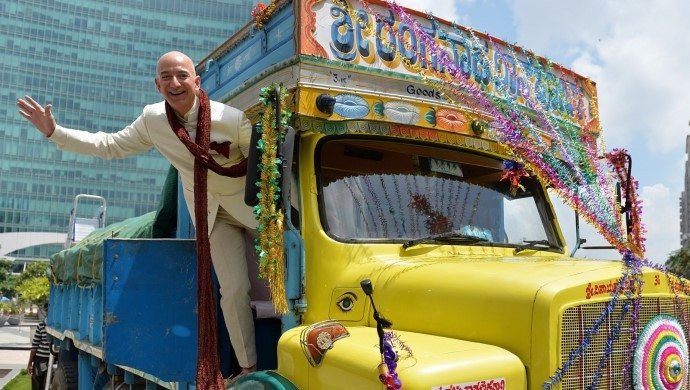

Amazon Founder Jeff Bezos

That said, Flipkart is still the market leader even though the divide between the two giants is narrowing. It has also made some strategic moves of late, which include the acquisition of Rocket Internet-backed Jabong last month.

More discounts means more bleeding

But this is not enough. As Flipkart is growing, Amazon is also growing. So, to stay relevant, the two companies will have to provide more discounts to customers, which means more bleeding and it is not good for margins. “This is a big problem for Flipkart, as it has a huge pressure on it to become profitable, whereas Amazon, which entered India much later, has enough time to show returns,” observes Jayadevan.

According to an active serial investor and a well-known figure in the e-commerce industry, Amazon has clearly several things going for it in India that will pose a big challenge to Flipkart.

“Amazon has huge capital to back its India operations; it does not have to raise money continuously and has a large war chest while companies like Flipkart and Snapdeal have to rely on subsequent fund-raises to be able to operate at some reasonable level,” the person said requesting anonymity. “Secondly, Amazon’s execution is flawless and time-tested, although it is more for other geographies and that it doesn’t take into account unique India challenges. Amazon has brought several good practices to India, has constantly learnt and caught up very fast, being a late entrant.”

Other key things that go in favour of Amazon is that its seller ecosystem management is far superior than Flipkart’s, given the fact that they don’t have own entity selling like WS retail (owned by Flipkart), whereas the Bangalore firm flip flopped between having own inventory model to marketplace model, losing some momentum in the process.

L-R Sachin Bansal, Co founder & CEO, Flipkart, Mukesh Bansal, Co-founder and CEO of Myntra, Binny Bansal, Co founder & COO, Flipkart

“Amazon has a visionary leader, Jeff Bezos, who is obsessive about customer experience and focus. He is a long term player and in no hurry and willing to invest in India many more billion dollars. He is not looking to monetise or create a liquidity event, given that Amazon is already a listed entity. So the time frame horizon is very different for Amazon – not just the capital available in their balance sheet,” the person added.

According to several other people who have been tracking the Indian e-commerce industry, customer service and experience for Flipkart has deteriorated, and with the entry of multiple players, it has lost the first-mover advantage. Now, customers have multiple options and the bar has been raised in terms of offers, customer service, quality and stickiness.

Raj K Mitra, an investment expert and former journalist, also bets on Amazon.

Also Read: Snapdeal is exploring possible merger with Flipkart and Amazon: Report

“For Amazon, India is a battle it can’t afford to lose and Jeff Bezos has made no bones about it. In a crowded e-commerce space where it’s increasingly difficult to find a USP and where tech is hardly a distinct differentiator in the consumers’ eyes, Amazon has two distinct advantages over its India-grown rivals: – brand recall among consumers is higher (a recent Nielsen study is proof) and its own deep pockets which means it won’t have to worry about sustaining the battle until the enemy bleeds to death,” he says.

“Flipkart, on the other hand, will have to hit the market in the future to shore up its war chest, and its frothy valuations could very well come in the way. Simply, this race isn’t about finishing first, but about who would be the last man standing near the finishing line. I would put my money on Amazon,” he adds.

But Flipkart cannot be written off just yet. Given the number of products being shipped, Flipkart is still the market leader, says another expert.

“They have delivery and logistics arm that is robust and well organised. That itself is a strong business and independently valuable. Their solutions are tailored to the Indian market and they have built it grounds up for Indian conditions,” the person said, who also requested anonymity.

Flipkart understands the Indian consumer and conditions better though Amazon is quickly closing the gap. “There will be a second player albeit valued much lower in a country with huge size and complexity. So, I would not write them off yet any time soon. That said, the valuation will be a challenge and defending the US$15 billion tag will be very difficult,” the person added.

According to Jayadevan, over the last two years, Flipkart has been getting negative publicity because it has flip-flopped on management rejig several times. Earlier, it was the founders and their closely-knit team that called the shots at the company. But since the acquisition of Myntra, the company brought in several top executives from Silicon Valley to make it look like a big MNC. The new execs brought in new officers and the organisation was realigned once again to the new structure. But then once again, the company brought its founders back — creating huge confusion and discomfort among its ranks and files, he adds.

“This Diwali will be important for e-commerce companies in India. At the end of the festive season, we’ll see early signs of who’s pushing the pedal and pulling ahead. We’ll also see if the market is growing as expected. It’s very hard to tell how it will play out in the long term though,” concludes Jayadevan.

E-commerce in India is certainly at a tipping point. As the market is getting matured and more and more players coming in, major companies will have to sweat it out to stay afloat, but it should not come at the expense of more discounts and offers. And in matter of two to three years, we will get a clear picture as to who is going to be the real e-commerce king.

The post With Alibaba in the horizon, who among Flipkart and Amazon will be the king of India’s e-commerce scene? appeared first on e27.